When I first learned that my grandmother needed dental implants but was worried about the cost, I discovered something that changed everything: dental implant financing in Dallas has evolved dramatically, making this life-changing treatment accessible to almost everyone. What once seemed like an impossible financial burden can now be broken down into manageable monthly payments, often with little to no interest.

If you’re facing a similar situation—needing dental implants but concerned about the upfront costs—you’re not alone. The good news is that Dallas offers some of the most comprehensive financing options in the country, and understanding these choices can be the difference between getting the treatment you need today versus waiting years to save up.

Key Takeaways

- Multiple financing options are available in Dallas, including dental-specific loans, healthcare credit cards, and in-house payment plans

- 0% interest promotions are commonly offered for qualified applicants, making treatments more affordable

- Medicare coverage is limited for dental implants, but supplemental insurance and alternative funding sources can help

- Credit requirements vary significantly between financing options, with solutions available for all credit levels

- Planning ahead and comparing multiple financing sources can save you thousands of dollars on your dental implant treatment

Understanding Dental Implant Costs in Dallas

Before diving into financing options, it’s essential to understand what you’re financing. Dental implant costs in Dallas can vary significantly based on several factors:

Average Cost Breakdown

- Single implant: $3,000 – $6,000

- Multiple implants: $6,000 – $30,000+

- Full mouth reconstruction: $20,000 – $80,000+

These costs typically include the implant post, abutment, and crown, but additional procedures like bone grafting or sinus lifts may increase the total investment.

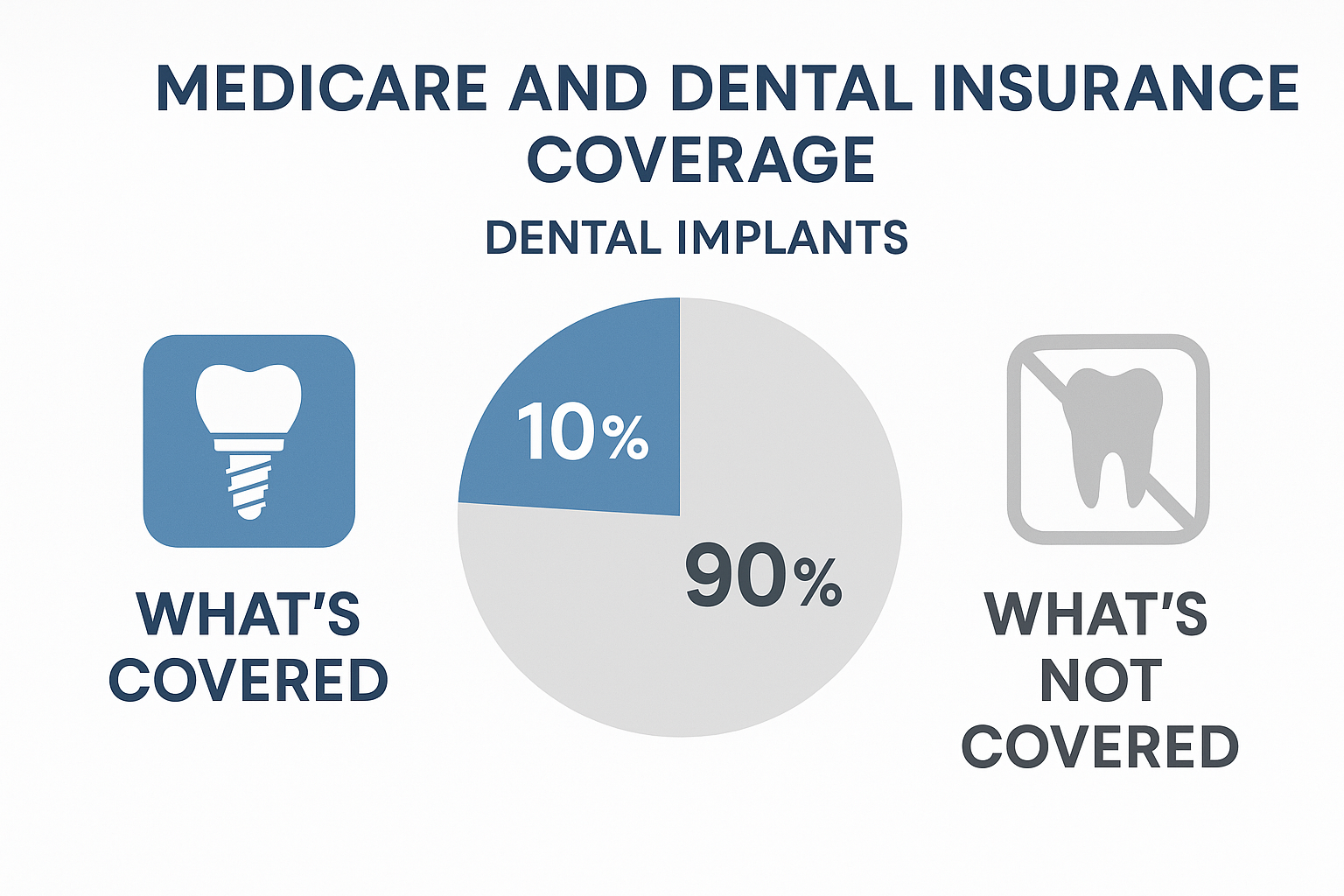

Medicare and Dental Implant Coverage: What You Need to Know

Since you’re interested in Medicare coverage for dental implants, let me address this directly: Original Medicare (Parts A and B) does not cover dental implants in most cases. However, there are some exceptions and alternatives:

Limited Medicare Coverage Scenarios

- Hospital-based procedures: If your implant surgery requires hospitalization due to medical complications

- Accident-related treatment: When implants are needed due to an accident or trauma

- Cancer reconstruction: Post-cancer treatment reconstruction may qualify for coverage

Medicare Advantage Plans

Some Medicare Advantage plans offer dental benefits that may include:

- Annual dental allowances ($1,000 – $3,000)

- Partial coverage for major dental work

- Network provider discounts

Supplemental Dental Insurance

Consider these options to bridge the coverage gap:

- Standalone dental plans: Specifically designed for seniors

- Dental discount plans: Immediate savings without waiting periods

- Employer-sponsored retiree benefits: If available from your former employer

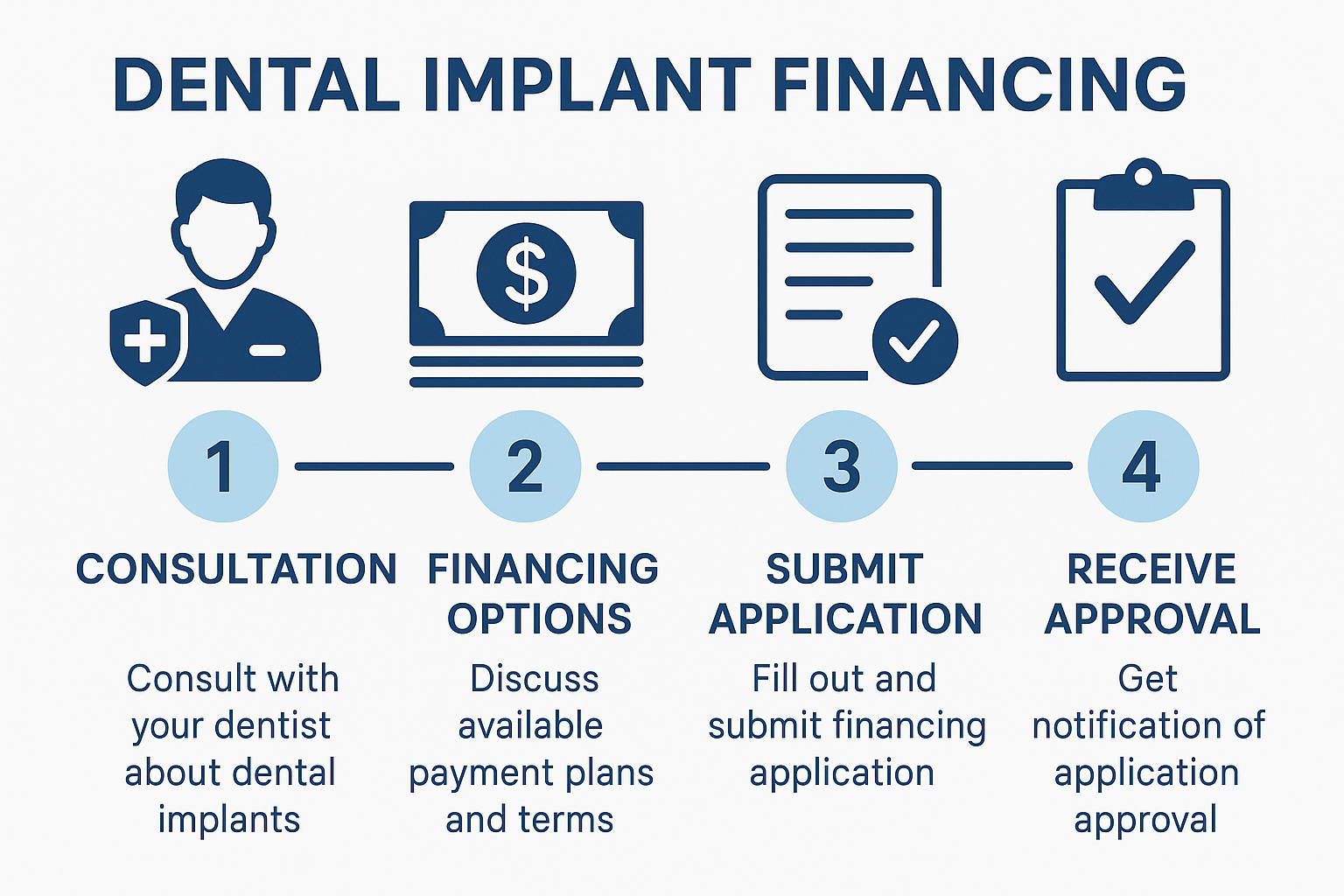

Top Dental Implant Financing Dallas Options

1. CareCredit Healthcare Financing 💳

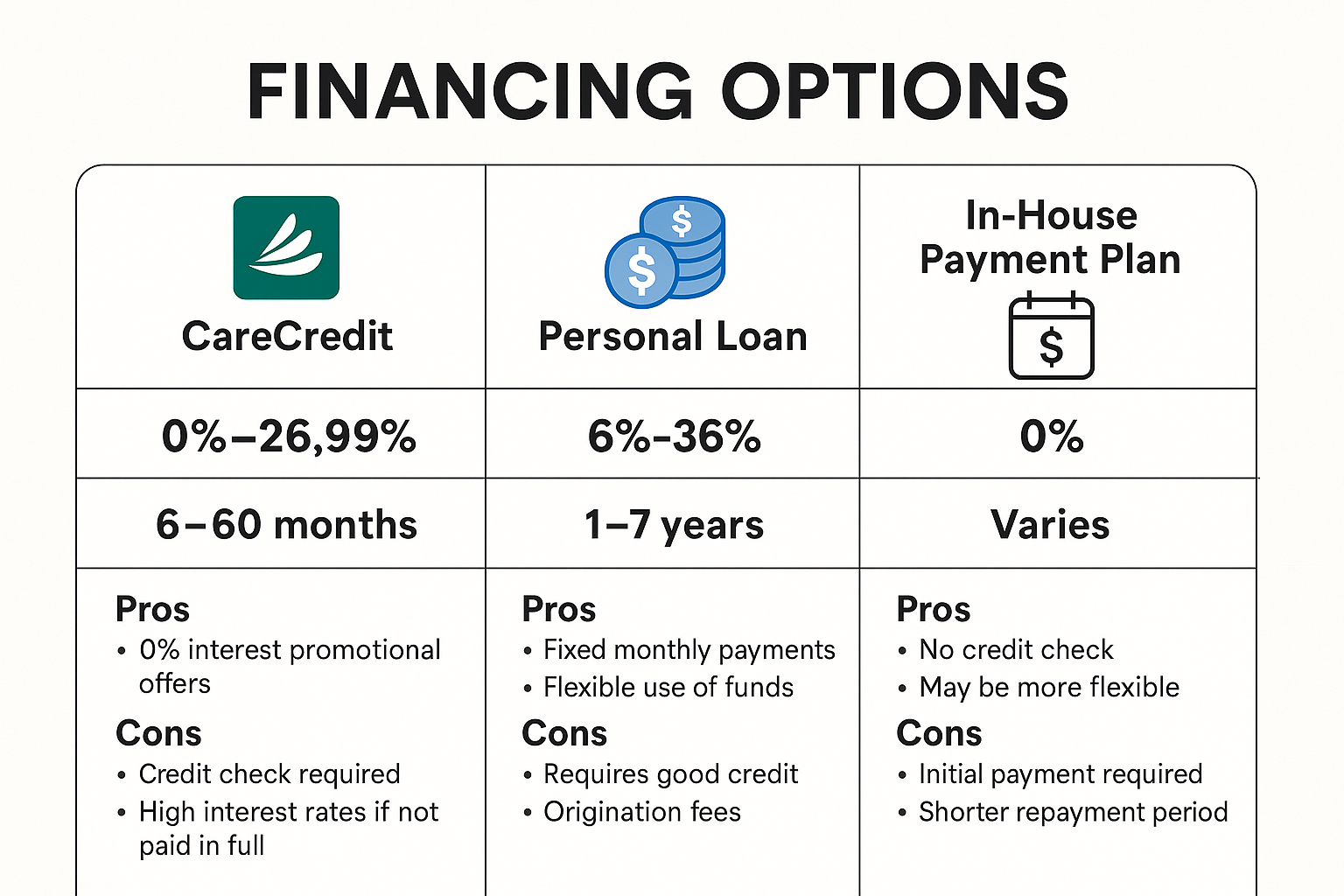

CareCredit is the most popular healthcare financing option, offering:

- Promotional periods: 6, 12, 18, or 24 months with 0% interest

- Extended payment plans: Up to 60 months with fixed interest rates

- Immediate approval: Often within minutes

- Wide acceptance: Most Dallas dental offices accept CareCredit

Pros:

- No annual fees

- Can be used for multiple family members

- Covers other healthcare expenses

Cons:

- High interest rates if promotional period expires

- Requires good to excellent credit for best terms

2. Lending Club Patient Solutions

Lending Club offers medical loans specifically for dental procedures:

- Loan amounts: $1,000 – $40,000

- Terms: 24 – 60 months

- Fixed interest rates: Typically 6% – 36% APR

- No prepayment penalties

3. Prosper Healthcare Lending

Prosper specializes in healthcare financing with:

- Quick approval process: Often same-day decisions

- Flexible terms: 24 – 84 months

- No collateral required

- Fixed monthly payments

4. In-House Dental Office Payment Plans

Many Dallas dental practices offer their own financing options:

- 0% interest payment plans: Often 6-12 months

- Extended payment schedules: Customized to your budget

- No credit checks: Some offices offer this option

- Flexible down payments: Often negotiable

Alternative Financing Strategies

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

If you have an HSA or FSA, dental implants are typically covered expenses:

- Tax advantages: Use pre-tax dollars

- No interest: You’re using your own money

- Immediate availability: If funds are available

Personal Loans from Banks and Credit Unions

Traditional personal loans can offer competitive rates:

- Credit unions: Often offer lower rates to members

- Local banks: May have special healthcare loan programs

- Online lenders: Quick approval and funding

Dental Schools and Training Programs

Consider these cost-saving options:

- Baylor College of Dentistry: Offers reduced-cost treatments

- Dental residency programs: Supervised care at lower costs

- Clinical trials: Potential for free or reduced-cost treatment

How to Choose the Right Financing Option

Step 1: Assess Your Financial Situation

- Credit score: Check your score to understand available options

- Monthly budget: Determine comfortable payment amounts

- Timeline: Consider when you need the treatment completed

Step 2: Compare Interest Rates and Terms

- APR comparison: Look beyond promotional rates

- Total cost: Calculate the full cost over the loan term

- Penalties: Understand late payment and early payoff terms

Step 3: Read the Fine Print

- Promotional period details: What happens when 0% expires?

- Fees: Application, origination, or maintenance fees

- Credit requirements: Minimum score and income requirements

Interactive Financing Calculator

💰 Dental Implant Financing Calculator

Tips for Getting Approved for Dental Implant Financing Dallas

Improve Your Credit Score

- Pay down existing debt: Lower your credit utilization ratio

- Check credit reports: Dispute any errors you find

- Avoid new credit applications: Don't apply for multiple loans simultaneously

Gather Required Documentation

Most lenders will require:

- Proof of income: Pay stubs, tax returns, or Social Security statements

- Bank statements: Recent statements showing financial stability

- Treatment plan: Detailed estimate from your dental provider

- Insurance information: Any applicable dental insurance details

Consider a Co-Signer

If your credit isn't ideal, a co-signer can:

- Improve approval odds: Lender considers both credit profiles

- Lower interest rates: Better terms based on combined creditworthiness

- Increase loan amounts: Higher borrowing capacity

Maximizing Your Dental Insurance Benefits

Even though Medicare doesn't cover implants, you may have other insurance options:

Dual Coverage Strategies

- Supplemental dental insurance: Can provide additional coverage

- Employer retiree benefits: Check if your former employer offers dental coverage

- Spouse's insurance: If applicable, coordinate benefits for maximum coverage

Timing Your Treatment

- Plan across benefit years: Split treatment to use multiple years' benefits

- Maximize annual limits: Use full annual benefits each year

- Coordinate with FSA/HSA: Time contributions to match treatment schedule

Questions to Ask Your Dallas Dental Provider

Before committing to any financing option, ask these important questions:

About Treatment Costs

- "What is included in the quoted price?"

- "Are there any potential additional costs?"

- "Do you offer package deals for multiple implants?"

- "What happens if complications arise during treatment?"

About Financing Options

- "What financing companies do you work with?"

- "Do you offer in-house payment plans?"

- "Are there any discounts for paying in full upfront?"

- "Can treatment be phased to spread costs over time?"

Red Flags to Avoid

When exploring dental implant financing in Dallas, watch out for:

Predatory Lending Practices

- Extremely high interest rates: Rates above 30% APR

- Hidden fees: Undisclosed application or maintenance fees

- Pressure tactics: Being rushed into signing agreements

- No cooling-off period: Inability to cancel within a reasonable timeframe

Unrealistic Promises

- Guaranteed approval: Legitimate lenders always check creditworthiness

- Too-good-to-be-true rates: If it seems unrealistic, it probably is

- No documentation required: Reputable lenders always verify income and identity

Planning for Long-Term Dental Health

Maintenance and Follow-Up Costs

Factor in ongoing expenses:

- Regular cleanings and checkups: $200-400 annually

- Potential repairs: Crowns may need replacement every 10-15 years

- Additional treatments: Other dental work that may be needed

Insurance Considerations

- Future coverage changes: Medicare Advantage plans may add dental benefits

- Supplemental insurance: Consider adding dental coverage for future needs

- HSA contributions: Continue contributing for future dental expenses

Working with Dallas Dental Professionals

Choosing the Right Provider

When selecting a dental implant provider in Dallas, consider:

- Experience and credentials: Board certification and implant-specific training

- Technology and techniques: Modern equipment and up-to-date procedures

- Financing partnerships: Established relationships with multiple financing companies

- Patient reviews: Real experiences from other patients

Getting Multiple Opinions

Don't hesitate to:

- Consult multiple providers: Compare treatment plans and costs

- Ask for detailed estimates: Get everything in writing

- Verify credentials: Check licensing and certifications

- Review financing options: Each practice may offer different arrangements

State and Local Resources in Dallas

Texas-Specific Programs

- Texas State Health Services: May offer information on dental assistance programs

- Local health departments: Community dental health resources

- Charitable organizations: Organizations that help with dental care costs

Dallas-Area Resources

- United Way of Metropolitan Dallas: May have dental assistance programs

- Local churches and community organizations: Often provide healthcare assistance

- Dental societies: Dallas County Dental Society may have referral programs

Making Your Decision

Creating a Financing Strategy

- Calculate total costs: Include all treatment phases and potential complications

- Compare all options: Don't just look at monthly payments—consider total cost

- Plan for contingencies: Have a backup plan if your first choice doesn't work out

- Consider timing: Align treatment with your financial calendar

Taking Action

Once you've chosen your financing option:

- Read all documents carefully: Understand every term and condition

- Keep detailed records: Save all paperwork and correspondence

- Set up automatic payments: Avoid late fees and protect your credit

- Communicate with your provider: Stay in touch about treatment progress and any changes

Conclusion

Navigating dental implant financing in Dallas doesn't have to be overwhelming. With the variety of options available—from healthcare-specific credit cards to traditional loans and in-house payment plans—there's likely a solution that fits your budget and credit situation.

Remember that while Medicare doesn't typically cover dental implants, the combination of supplemental insurance, financing options, and strategic planning can make this life-changing treatment affordable. The key is to research your options thoroughly, understand all terms and conditions, and choose a reputable provider who works with multiple financing companies.

Don't let cost prevent you from getting the dental care you need. Start by contacting local Dallas dental providers to discuss your specific situation and explore the financing options they offer. Many practices provide free consultations where you can learn about treatment options and financing simultaneously.

Your smile and oral health are investments in your overall well-being and quality of life. With proper planning and the right financing option, you can achieve the dental health you deserve while maintaining your financial stability.

Take the first step today by using the calculator above to estimate your potential monthly payments, then reach out to Dallas dental professionals to begin your journey toward a healthier, more confident smile.